Our lives revolve around places. Every day its your home, office, neighboring shops, malls, parks or dining out and when you traveling its the airports, train stations new cities/countries, tourist attractions etc.

This is how place information over internet has evolved over time.

Pre-internet era (before 1990) – Yellowpages / books / guides.

1990- 2000 – This was the era when yellow pages went online. Information available remained the same but now searchable (a BIG change).

Amazon allowed customers to leave reviews of products (in 1995). Letting consumers rant about products in public was a recipe for retail suicide, critics thought 🙂

Trivia: Elon Musk (& his brother) founded Zip2 in 1995 & later was acquired by Compaq in 1999 for $305 million

2000 – Online reviews / ratings started. Epinions, RateitAll & Deja were the early movers. People could now leave feedback for almost any kind of business, product or place. This fundamentally changed the dynamics of how places were discovered and consumed. Tripadvisor was founded.

2007 to 2019 – The period with maximum action in this space

- Yelp takes off with millions of reviews.

- Foursquare is founded and introduces concept of social check-ins

- TripAdvisor is firmly the largest travel site in the world. With close to half a billion monthly vists and very profitable!

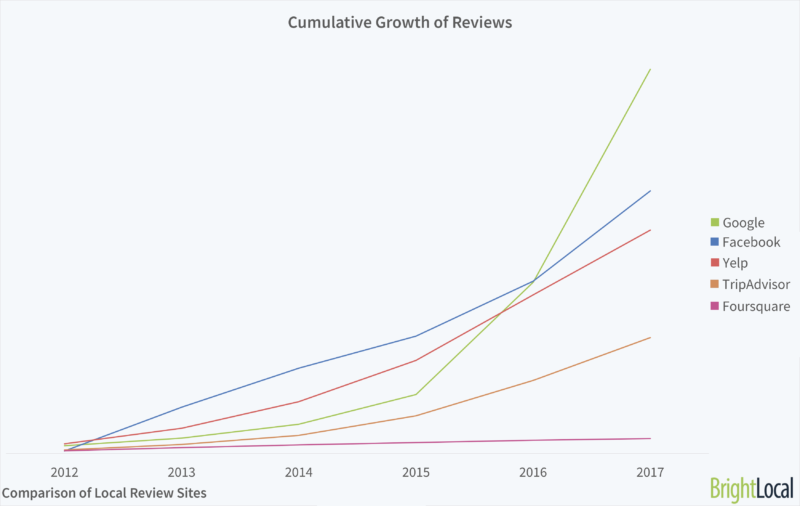

- In 2012, Facebook comes from nowhere and has the largest quantity of reviews, only to be beaten by Google in 2017 as Google introduces smart notifications and tweaks their search algorithm to give more weightage to business ranks.

If you look at the last 20 years, places and their information has largely remained unchanged

– Reviews & ratings are more or less same. Mainly text first & then photo/video and primarily opinions of the past.

– Information you get is the same – phone numbers, location, working hours etc

– Social networks have added layer of recommendations directly from your friends.

The future of places on internet – consumption and creation

Next 2 decades will redefine how we discover places, share our feedback and build new forms of engagements. I define them broadly under

1. Live Information

2. Augmented Reality

3. Real-time communication

4. Ephemeral Communities

- Live information – A new layer of information will be created on the web – live information of places with context.

– Similar to what twitter does for topics today (follow any event in the world via certain hashtags), we will have a network that will allow you to tap any place/locality in the world.

– Visualize in realtime what is happening and also have context with engagements via audio commentary, augmented reality, comments, polling etc.

An example of how we do this at Markk

2. Augmented reality – Reviews/ratings in future will involve people seeing AR models of places and creating their own versions of it and then sharing their experiences as it happens.

Example people will visualize a Taj Mahal or a shopping street in AR, build their own version of the place, share snippets of that as stories and a community that can build on top of this.

What Snap is building with their local lenses and Landmarkers feature is very interesting

3. Real-time communication – As chat between friends is instantaneous, our places experiences will also become live. Before going to the park I will not only quickly visualize the place (for crowd, seating, rush etc) but also engage with the people there on the go.

Businesses will have a more robust live presence. Today businesses struggle with multiple platforms, devices and hence majority remain inactive. A real-time model will help them realize immediate impact and return on investment.

4. Ephemeral communities around places –

A network of places that will create short duration social bubbles. Connect with people who happen to share your likes of a place at that moment (but are otherwise strangers).

Example, connect with people at your boarding gate, engage with people who are or plan to be at the same bar, at sports stadiums and so on.

A network of places that connects people will be an interesting aspect of consumer internet in coming years and will redefine local discovery.

Data sources ShopperApproved ChatMeter SearchEngineLand HBR